Price to Book Ratio Formula

Price to Tangible Book Value - PTBV. Market Value Per Share Book Value Per Share Generally a ratio below 1 indicates the company stock is undervalued while above 1 means its overvalued.

What Is The Price To Book Ratio Market Business News

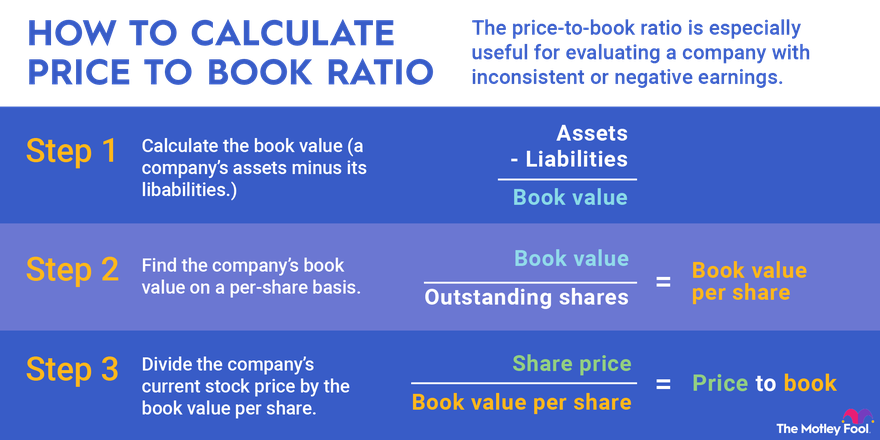

The price-to-book ratio formula is calculated by dividing the market price per share by book value per share.

. As a result the Book Value of each share. AAA 2016 estimated Book Value is 4000 and its current price is 234. The Price to Book ratio determines the relationship between the companys total outstanding shares and the net value of assets reflected in the balance sheet.

Investors use the price-to-book value to gauge whether a companys stock price is valued properly. The ratio can also be calculated as total market value over total book value as the per-share part in the equation washes out. The following graph shows the price-book value ratio as a function of the difference between the return on equity and.

BVE 5bn 4bn 1bn. Price to book ratio is a great tool to quickly determine whether a. Price to tangible book value ratio 138.

To wrap up our price-to-book ratio PB calculation under the first approach we can divide the market. Jul 18 2022 1150 AM. A PB ratio of one means that the stock price is.

Nevertheless the price to book value formula is expressed. Market value per share is obtained by simply looking at the share price quote in the market. Market to Book Ratio 697.

PBRatioMarketPriceperShareBookValueperSharePB Ratio dfrac See more. Tangible book value per share 5793 USD. Once you have the numbers entered into the formula you can divide to find the result.

Book Value of Equity BVE Assets Liabilities. Trailing PB Ratio 234 500 05x. If we put the annual values into our price to book ratio calculator we will get a PB ratio of.

In a roundabout way this value represents the equity value of an organisation. The two ways of calculating the same ratio are depicted above using the example of the company-. In this equation book value per share is calculated as follows.

The market price per share is simply the current stock price that the company is. The formula for price-to-book ratio is. The price to tangible book value PTBV is a valuation ratio expressing the price of a security compared to its hard or tangible book value.

Total assets - total liabilities number of shares outstanding. Likewise we can calculate the Forward Price to Book Value ratio of AAA Bank. The book value of each share can be easily estimated by dividing the Total Shareholders Equity 45980000 by the number of shares outstanding.

Market Capitalization current share price. Consequently its price-book value ratio declined from 789 to 125. Market to Book Ratio 821979400000 117892000000.

Book value of assets Total assets total liabilities. We can use the other formula for price to book value ratio Market Capitalization Book Value of Equity to calculate the PB ratio of company XYZ. PB ratio 600 300.

The price-to-book ratio is a metric that analyzes a companys shares against its balance sheet to see if the stock is over- or undervalued. PB ratio Market price per share Book value per share.

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

Price To Book Ratio P B Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Using Price To Book Ratio To Analyze Stocks

Price To Book Ratio Definition Formula Using To Use It

Price To Book Ratio P B Formula And Calculator Excel Template

0 Response to "Price to Book Ratio Formula"

Post a Comment